PRIVATE DEALS LEAD PHARMA M&A WITH FEW PUBLIC TARGETS AVAILABLE

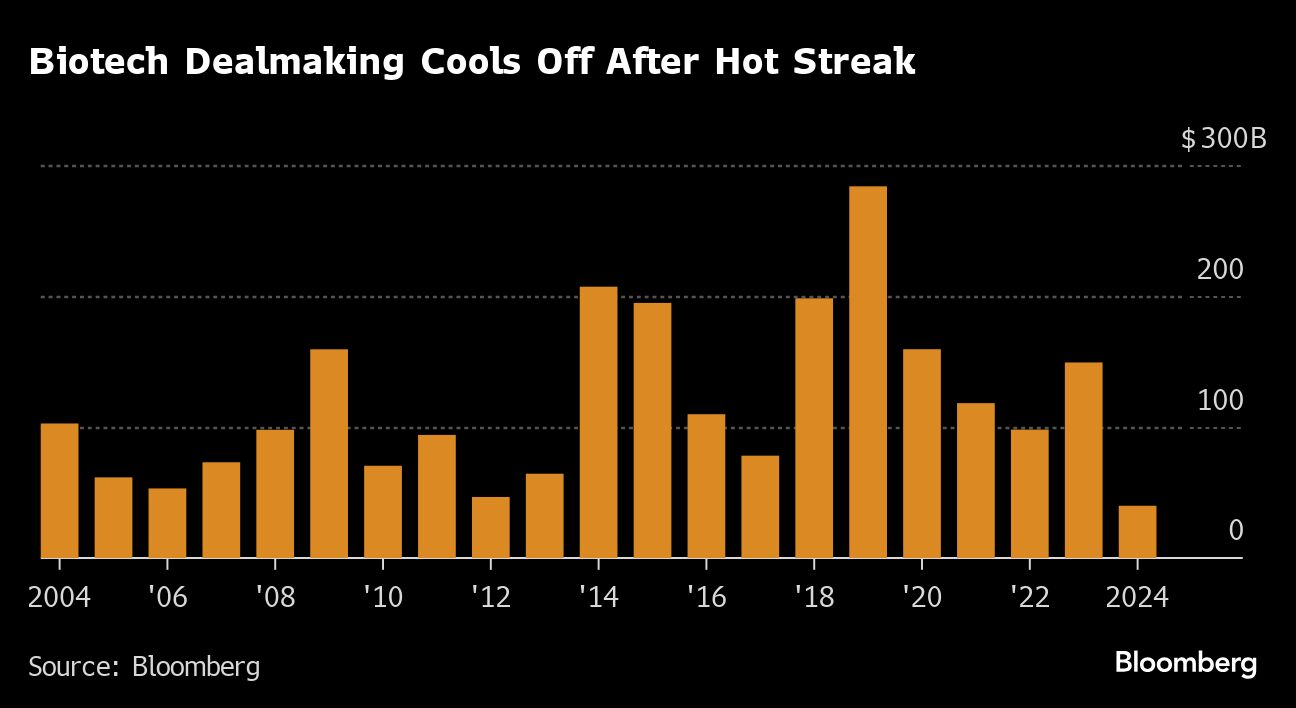

(Bloomberg) -- After defying the biggest dealmaking downturn in a decade, Big Pharma is taking a little breather from chasing public companies in favor of smaller, private targets.

Drugmakers including Bristol Myers Squibb Co. and Abbvie Inc. spent heavily on targets during the later months of last year, often paying hefty premiums in a bid to refresh aging portfolios with new blockbuster medicines.

But the hot streak has cooled off in 2024, with the value of biotech deals down by more than 40% year-on-year to about $40 billion, even as mergers and acquisitions rebound in other industries, data compiled by Bloomberg show.

Dealmakers and health-care executives say that a $50 billion-plus flurry of transactions that took place in the final quarter of 2023 temporarily eliminated a lot of obvious targets — those with drugs close to hitting the market and near-term revenue potential.

“We’re going through a period of digestion,” Chris Roop, head of Americas M&A at Jefferies Financial Group Inc., said on the sidelines of the bank’s global heath-care conference in New York last week. “A lot of the fully de-risked companies that would be targets have been taken off the board.”

Big Pharma still needs to buy in order to find innovative treatments and replenish top lines. Bloomberg Intelligence analysts Michael Shah and John Murphy recently estimated that the industry’s biggest names in the US have $180 billion in annual sales that are at risk from patent expirations between now and 2030.

With fewer obvious public targets to chase, one trend that has emerged in health-care dealmaking this year has been the pursuit of smaller private companies. Pharma takeovers of private biotechs are up 198% so far this year, according to data compiled by Bloomberg.

Last month, Merck & Co. agreed to buy Eyebiotech Ltd. for $1.3 billion upfront to restock its cabinet of eye treatments; Biogen Inc. said it would pay as much as $1.15 billion upfront for Human Immunology Biosciences Inc. to bolster its pipeline of immune disease treatments; and Johnson & Johnson struck an $850 million deal for Proteologix Inc., giving it access to a potential new atopic dermatitis drug.

New Generation

With initial public offerings still climbing back from a two-year lull, and amid a choppy market for biotech stocks, a new generation of companies has been left to get closer to developing new drugs in the private markets. These firms have drawn the attention of Big Pharma companies, even if their revenue-generating potential lies further up the road.

“I suspect some of the companies that have done some of these private deals have thought ‘this is a good moment for us to be hunting in those grounds’,” said Matt Gline, the chief executive officer of Roivant Sciences Ltd., which sold an asset to Roche Holding AG last year for $7.1 billion. “The premiums are different, the needs are different, the opportunity’s different.”

To be sure, the likes of Bristol Myers, Abbvie and Pfizer may just be taking a break from large-scale M&A after each spending at least $15 billion on acquisitions last year. Pfizer CEO Albert Bourla said on Monday that the company is hitting pause on big acquisitions following its landmark purchase of Seagen Inc. in 2023.

Still, dealmakers predict that a rebound in public transactions will come soon enough.

“Big Pharma still has the same challenges and the only way for them to solve this is through BD [business development] and M&A,” Jefferies’s Roop said. “I feel optimistic that we’ll continue to see deal-flow.”

J&J is one drugmaker that’s likely poised to participate in any rebound, according to Nauman Shah, global head of business development for its pharmaceutical segment.

“We certainly still have the financial capability and the power to be able to do deals regardless of what size they are,” he said in an interview at last week’s BIO International Convention in San Diego. “We’re going to focus more on deals that are in that five to let’s even call it $20 billion range if they make sense. We’re not afraid to go to those levels.”

(Adds detail on Pfizer CEO comments in 11th paragraph.)

Most Read from Bloomberg

- Musk to Ban Apple Devices If OpenAI Is Integrated Into OS

- Hunter Biden Convicted of Gun Charges by Jury in Delaware

- Apple Hits Record After Unveiling ‘AI for the Rest of Us’ Plan

- NYC Landlord to Sell Office Building at Roughly 67% Discount

©2024 Bloomberg L.P.

2024-06-10T15:30:32Z dg43tfdfdgfd